US oil & gas player gets cracking on development studies as two out of three Gulf of Mexico wells yield hydrocarbons

U.S.-headquartered privately owned exploration and production company LLOG Exploration has started the ball rolling on development studies for two hydrocarbon-bearing wells in its three-well exploration/appraisal campaign. The wells are located in the U.S. Gulf of Mexico, which is being renamed the Gulf of America.

After LLOG disclosed plans to spud the Who Dat East appraisal/exploration well and the Who Dat South exploration well in the Gulf of Mexico with Noble’s Noble Valiant drillship and Seadrill’s West Neptune drillship, respectively, the first was drilled at the end of April 2024.

The data indicated a hydrocarbon-bearing aggregate total net pay thickness of 44 meters measured depth (MD) within the targeted intervals, with 31 meters MD within two discrete reservoir units. The Who Dat East joint venture (JV) participants are LLOG (operator, 40%), Karoon (40%), and Westlawn (20%).

LLOG expected to begin drilling the Who Dat South prospect toward the end of Q2 2024. The Who Dat West exploration well was anticipated to be drilled later in 2024. According to Karoon, two of these three wells ended up being successful; thus, it revised its net revenue interest (NRI) for Who Dat East 2C contingent resource up 190%, from 5.4 million barrels of oil equivalent (boe) to 15.7 million boe after integrating the results of the MC 509-1 appraisal/exploration well.

The revised contingent resource estimates are said to include data from wireline logs, fluid samples, and subsurface studies. Therefore, the joint venture, led by LLOG, has begun development concept studies, and the results will assist in the technical and commercial assessment of the potential development of Who Dat East.

Related Article

The Who Dat South exploration well, MC 545-1, located 11 kilometers west of the Who Dat floating production system (FPS) and 6 kilometers from the Who Dat G subsea manifold, was drilled by LLOG in the fourth quarter of 2024 to a final total depth of 7,014 meters MD.

After the well encountered several hydrocarbon-bearing sandstone intervals through the targeted Miocene zones, preliminary interpretation indicated the hydrocarbon-bearing zones have an aggregate true vertical thickness (TVT) of 67 meters.

This comprised approximately 51 meters TVT in the 12-¼” hole section and a further 16 meters in the 8-½” hole section based on logging while drilling and drilling parameters, with results exceeding Karoon’s pre-drill prognosis of 40 meters.

Furthermore, the initial analysis of formation pressure measurements and fluid samples indicated the presence of a high liquid yield gas-condensate fluid. As a result, the well was suspended as a potential future producer pending the completion of the JV studies on potential development concept options.

Unlike the previous two, the Who Dat West exploration well, MC 629-1, which was drilled toward the end of December 2025 and reached a final total depth (TD) of 7,147 meters in January 2025, led to no significant hydrocarbon-bearing intervals within the drilled section. The well has been plugged and abandoned.

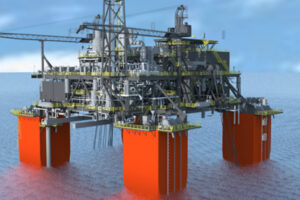

Located in 800 meters of water offshore Louisiana within federal waters of the U.S. Gulf of Mexico, the Who Dat conventional deepwater oil and gas development, which came on stream in 2011, produces around 60% oil and 40% gas from nine wells processed through the Who Dat FPS and transported to markets through common carrier pipelines.

Dr Julian Fowles, Karoon’s CEO and MD, highlighted: “In the US, the Who Dat gross production for the quarter was 3% lower than in 3Q24, primarily due to the planned annual platform shutdown and gas compressor maintenance. As a mature asset, without interventions Who Dat production, is expected to naturally decline by approximately 15% pa on average.

“During 2024, natural decline was largely offset by well interventions, sidetracks and production system optimisations. 2025 production will also benefit later in the second half from two well interventions, in line with our long term aim to offset decline rates through periodic infield activities.”

The gross Who Dat production in Q4 2024 was 29,576 boe per day, 3% lower than the prior quarter when it amounted to 30,543 boepd, as the production was impacted by an extension to 18 days of the planned 10- to 14-day shut-down for maintenance due to Hurricane Rafael, and a gradual ramp-up, over approximately 10 days, to bring Who Dat back to full production.

The average realized price for Who Dat liquids – including oil, condensate and NGLs – was down 9% from the previous quarter, at $68.44/bbl, reflecting the decline in global oil prices. However, the Who Dat average realized sales gas price increased 8%, to $3.07/mcf, reflecting higher Henry Hub gas prices in December due to increased demand resulting from seasonal winter temperatures.

Commenting on the development studies for Who Dat East and South, Fowles emphasized: “Given their size and proximity to existing production infrastructure, we believe it is likely that they will both prove to be value-accretive development candidates.”