Transocean, Noble, Valaris, Borr, and Odfjell Drilling fleets’ $23 billion backlog spotlights state of play in booming rig market

Five offshore drilling players – Transocean, Noble Corporation, Valaris, Borr Drilling, and Odfjell Drilling – have secured a combined total backlog of $23.22 billion in the third quarter of 2024, which is higher than $23.03 billion in the second quarter of 2024 and $22.7 billion in the third quarter of 2023. All five, alongside multiple analysts and rig market intelligence research firms, anticipate busy times ahead with a further rise in rig demand over the next few years.

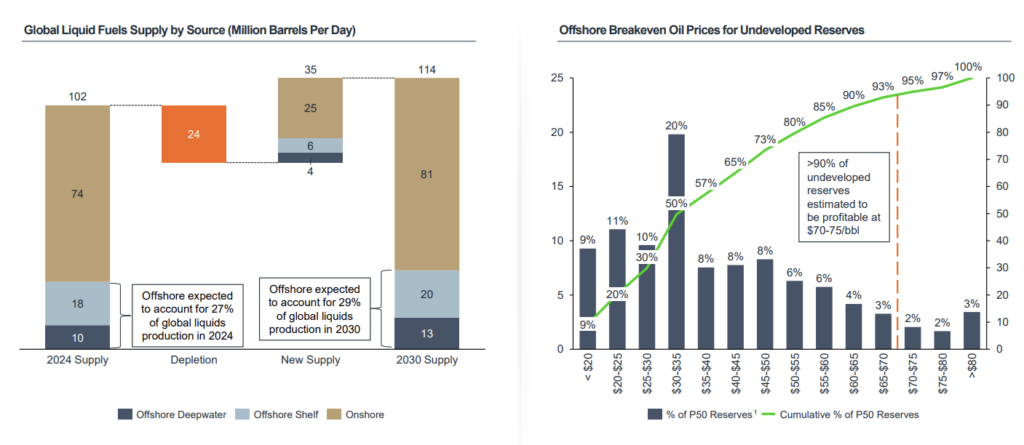

The global offshore drilling playground appears to be gearing up for even busier times ahead, especially in certain regions as the population growth continues to ratchet hunger pangs for energy to fuel daily activities and keep the lights on, whetting the appetite for further oil and gas exploration quests to develop untapped hydrocarbon resources.

With the Ukraine and Gaza crises still dragging on and new battlegrounds opening up as geopolitical tensions skyrocket, especially in the Middle East, energy security plays a key role in attempts some are making to find new hydrocarbon reserves. A slew of new multi-well campaigns are on the drilling agenda for the future, promising to unlock more oil and gas to prop up the security of the global energy mix.

Given the rise in climate change concerns, governments worldwide are determined to curb their greenhouse gas (GHG) emissions footprint, thus, they are imposing strict safety and environmental regulations on drilling technology and equipment, which coupled with potential sharp drops in oil and gas prices could derail planned offshore drilling projects.

However, general advances in drilling technology and subsea engineering alongside those aimed at minimizing the environmental footprint offer significant opportunities for rig owners to curb their costs, shorten drilling times, and bolster their overall operational and financial performance while tapping into deep and ultra-deepwater resources.

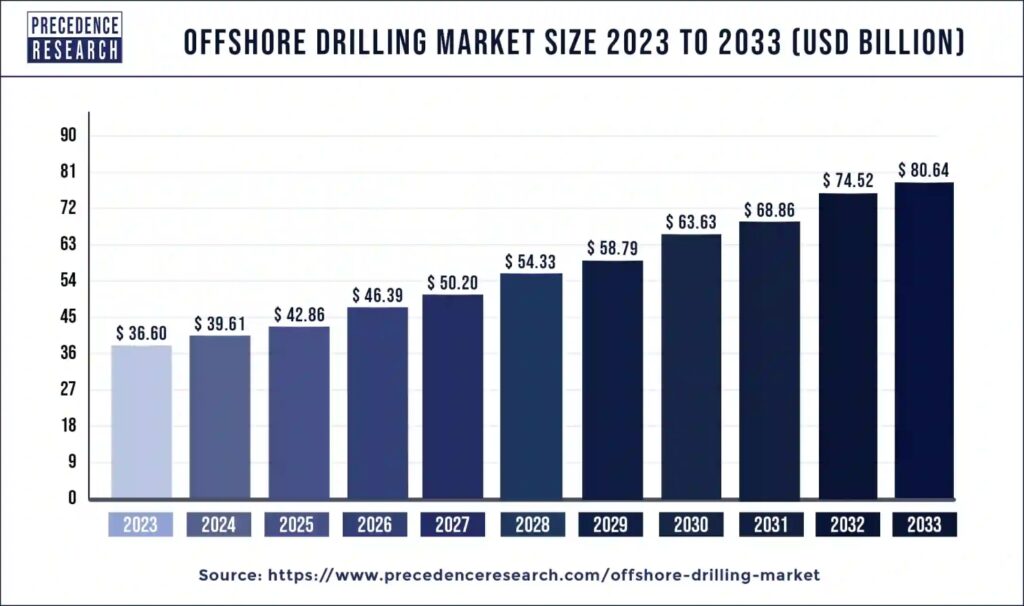

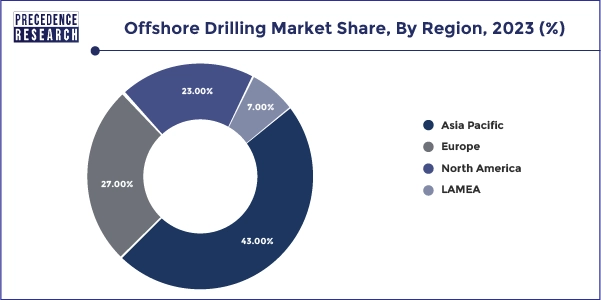

Based on Precedence Research’s analysis of the state of play in the offshore drilling market from 2024 to 2033, the market value is on course to reach approximately $80.64 billion by 2033 from $36.60 billion in 2023, growing at a CAGR of 8.22% from 2024 to 2033. The findings show that Asia-Pacific led the market with the largest market share of 43% in 2023 while Latin America is perceived as the fastest-growing market during the forecast period.

While all rig types were busy last year, the analysis shows that drillships dominated the offshore drilling market with the deepwater segment holding the largest revenue share of 43% in 2023. However, the shallow water segment is expected to grow the fastest during the forecast period.

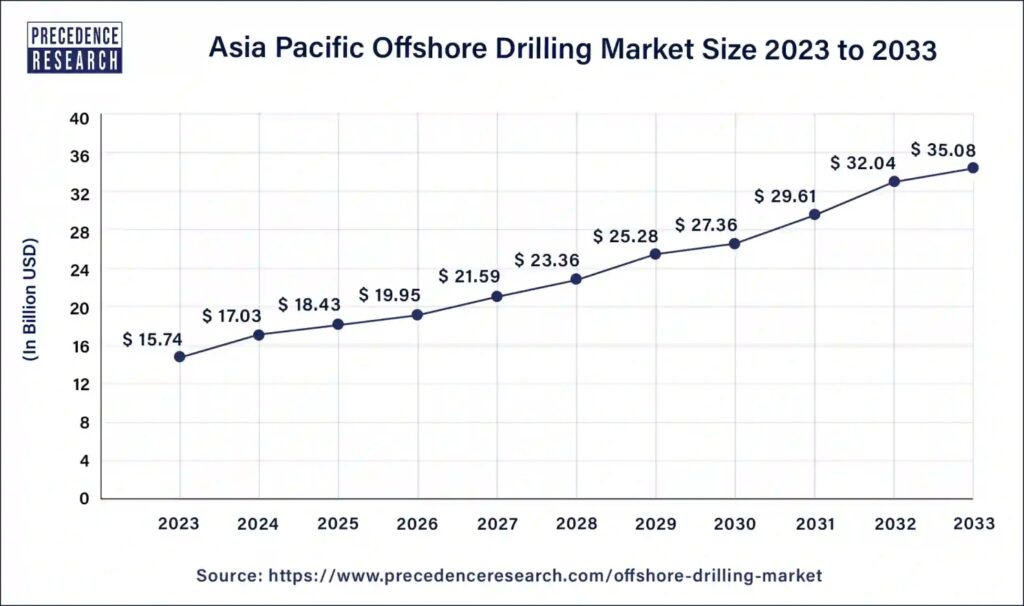

Furthermore, Precedence Research shows that the Asia Pacific offshore drilling market size, which was estimated at $15.74 billion in 2023, is forecast to be worth around $35.08 billion by 2033 at a CAGR of 8.34% from 2024 to 2033. The increase is believed to result from the spending boost countries in the area, such as China and India, have earmarked for offshore drilling to augment their energy sources and fulfill this growing demand.

With energy security in the driving seat, the region’s governments have set up laws to support offshore production and exploration, including tax breaks, infrastructural development investments, and preferential production-sharing contracts (PSCs) terms.

Moreover, the analysis pinpoints Latin America as the fastest-growing offshore drilling stage up to 2033 buoyed by improvements in deepwater drilling techniques, subsea infrastructure, seismic imaging, and drilling technology, alongside relative geopolitical stability in nations like Mexico and Brazil. This favorable political atmosphere is perceived to promote foreign investments and long-term planning in the offshore industry.

The findings indicate that the Middle East and Africa are also positioned for growth as natural gas becomes more and more relevant in the moves toward greener energy sources, thanks to its smaller carbon footprint than coal and oil. The offshore gas fields in the MEA region are anticipated to be among the actors playing steering roles in global attempts to diversify economies and boost investment in the energy industry, particularly in offshore drilling.

Countries like Saudi Arabia and the United Arab Emirates (UAE) are already pursuing strategic plans like Saudi Vision 2030 and UAE Vision 2021. While Namibia‘s Orange Basin is emerging as a new offshore drilling frontier thanks to recent oil discoveries, Nigeria, and Ghana are identified as being among African nations with sizable offshore oil reserves, and the Gulf of Guinea is expected to remain a prevalent location for offshore drilling due to its vast hydrocarbon potential.

While Europe has done the most to tighten laws governing GHG emission reductions to speed up its journey to net zero, this does not mean the continent will give up on oil and gas exploration and production during the next few years. The Europe offshore drilling market size, calculated at $9.88 billion in 2023, is projected to expand to around $22.18 billion by 2033, growing at a CAGR of 8.42% from 2024 to 2033.

An analysis from Fortune Business Insights shows that the global offshore drilling market size, which was reportedly valued at $36.52 billion in 2023, is projected to be worth $40.04 billion in 2024 and hit $74.94 billion by 2032, exhibiting a CAGR of 8.2% during the forecast period. The research points out that the offshore drilling market in the U.S. is set to grow to $3.75 billion by 2032, driven by the rise in energy consumption and export opportunities.

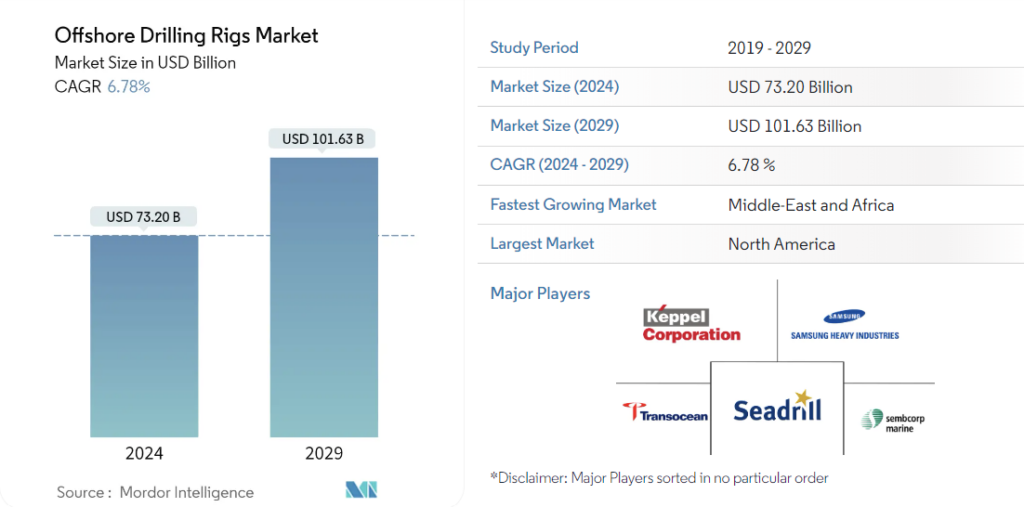

Mordor Intelligence, another market research player, is also predicting growth for the offshore drilling market, as its analysis shows that the market size is estimated at $73.20 billion in 2024, and is anticipated to rise to $101.63 billion by 2029, growing at a CAGR of 6.78% during the forecast period from 2024 to 2029, with increased global energy demand and exploration activities for untapped regions pushing the market forward.

While the rising environmental concerns over offshore drilling and its impact on the aquatic environment are predicted to hinder the market’s growth, rising deepwater and ultra-deepwater demand for exploration and production activities is forecast to create several future market opportunities, especially in North America, which is expected to be a major playground due to the latest technology and infrastructure for offshore activities.

Transocean’s backlog stands at $9.3 billion

The rig owner’s backlog was reported to be $9.3 billion in the fleet status report from October 2024, representing an increase from $8.8 billion in Q2 2024 but still slightly lower than $9.4 billion revealed at the end of October 2023. Transocean disclosed a net loss attributable to controlling interest of $494 million for the three months ended September 30, 2024, up from a loss of $123 million in Q2 2024 and $220 million in Q3 2023. The third quarter 2024 adjusted net income was $64 million, compared to a loss of $123 million last quarter and $280 million in Q3 2023.

Jeremy Thigpen, Transocean’s Chief Executive Officer, commented: “As illustrated by the nearly $1.3 billion in backlog booked in the third quarter, including the recent award for Deepwater Conqueror, the demand for our fleet of high specification ultra-deepwater and harsh environment rigs remains strong.

“With these most recent awards, more than 97% of Transocean’s active fleet is contracted in 2025, once again demonstrating that our customers clearly recognize Transocean’s unique capabilities – our rigs, crews and superior operational performance – add value to their programs.”

Related Article

-

Transocean rigs clinch $1.3 billion in offshore drilling gigs

Project & Tenders

The firm’s contract drilling revenues for the three months ended September 30, 2024, increased sequentially by $87 million to $948 million, primarily due to increased rig utilization, increased day rates for two rigs, higher reimbursement revenues, and a full quarter of revenues from the Deepwater Aquila newbuild ultra-deepwater drillship, partially offset by lower revenue efficiency across the fleet. This represents a $235 million increase year-over-year from $713 million in Q3 2023.

The company’s operating and maintenance expense was $563 million, compared with $534 million in the prior quarter and $524 million last year. The sequential increase is seen as the result of increased fleet activity, including a full quarter of operations from the Deepwater Aquila drillship, partially offset by reduced operating costs related to the Transocean Norge rig following the acquisition of Orion Holdings in June 2024.

If the circulating merger rumors about Transocean and Seadrill turn out to be accurate and the duo manages to strike a business combination deal, this would create a fleet of 49 rigs since the former owns or has partial ownership interests in and operates a fleet of 34 mobile offshore drilling units (MODUs), consisting of 26 ultra-deepwater floaters and eight harsh environment floaters while the latter operates 15 MODUs, encompassing 12 drillships, one niche semi-sub, and two harsh environment units, after exiting the jack-up segment in two transactions disclosed in September 2022 and June 2024.

Related Article

“With approximately $9.3 billion in backlog, and clear visibility to future demand, we will remain focused on delivering safe, reliable and efficient operations for our customers and continue to maximize cash generation to improve our balance sheet, as we did in the third quarter with $136 million of free cash flow,” highlightedThigpen.

Noble’s backlog reaches $6.2 billion

Following its merger with Diamond Offshore, Noble’s backlog stands at $6.2 billion, compared to $4.2 billion in Q2 2024 and $4.7 billion last year. Given Diamond Offshore’s total backlog of over $2 billion in Q2 2024 and $1.6 billion in Q3 2023, the combined total backlog appears to be in the same range as last quarter when the duo secured more than $6.2 billion but lower than $6.3 billion, which was recorded last year.

Robert W. Eifler, President and Chief Executive Officer of Noble Corporation, emphasized: “We are excited to have closed on the Diamond acquisition during the third quarter, enabling us to start capturing the value from the transaction earlier than expected. Our strategy of pursuing rational and accretive growth in the high-end deepwater segment toward an ultimate objective of maximizing cash returns to shareholders is yielding tangible results, as evidenced by robust third quarter free cash flow and a sector leading dividend and buyback program.

“Despite a more muted near-term demand environment than we had envisioned coming into this year, Noble is uniquely well positioned to deliver customer and shareholder value through various market conditions.”

Related Article

The rig owner’s contract drilling services revenue for the third quarter of 2024 totaled $764 million compared to $661 million in the second quarter of 2024, with the sequential increase driven primarily by an approximate four weeks of contribution from the legacy Diamond fleet. The Q3 2024 contract drilling services revenue is up from $697 million in the same period last year.

The firm’s marketed fleet utilization was 82% in the three months ended September 30, 2024, compared to 78% in the previous quarter. The U.S.-based giant’s contract drilling services costs for the third quarter of 2024 were $434 million, up from $336 million for the second quarter of 2024, with the sequential increase driven by the legacy Diamond fleet and partially offset by lower contract preparation and mobilization expenses.

The company’s net income decreased to $61 million in the third quarter of 2024, down from $195 million in the second quarter of 2024 and $158 million in Q3 2023. On the other hand, the adjusted EBITDA increased to $291 million in the third quarter of 2024, up from $271 million in the second quarter of 2024 and $283 million in the third quarter of 2023. The firm’s total assets are valued at nearly $8.04 billion.

Noble’s marketed fleet of 25 floaters was 81% contracted during the third quarter, including nine marketed floaters from the legacy Diamond fleet on a partial quarter basis from September 4, 2024, compared with 78% in the prior quarter. The U.S. player underlines that the industry-leading edge day rates for tier-1 drillships remain in the mid $400,000s to low $500,000s per day range.

The contract fixtures for lower specification floaters are said to have been limited in 2024 and are expected to reflect a softer utilization environment throughout 2025 due to continuing white space risk impacting all floater segments.

Related Article

The utilization of Noble’s thirteen marketed jack-ups improved to 83% in the third quarter, compared with 77% in the prior quarter, as leading-edge harsh environment jack-up day rates remain in the mid $200,000s per day in Norway and $130,000 to $150,000 per day in the rest of the North Sea. While the Northern Europe jack-up market continues to indicate the potential for a slight demand improvement in Norway for 2025, the firm notes that policy and permitting factors present potential headwinds for the Southern North Sea.

After last quarter’s earnings, ExxonMobil Guyana awarded an additional 4.8 years of backlog under the commercial enabling agreement (CEA), intended to extend the contract duration for each of Noble’s four drillships operating under the CEA from Q2 2027 to Q3 2028. In addition, the Ocean Endeavor rig has been awarded 130 more days with Shell in the UK North Sea.

Related Article

-

Noble rig trio drilling full steam ahead in search of more oil & gas for ExxonMobil offshore Guyana

Exploration & Production

Elaborating on Noble’s outlook for the future, Eifler stated: “We remain encouraged by the high level of tangible contract opportunities in our commercial pipeline which is expected to drive a backlog inflection sometime next year.

“In the meantime, Noble is poised to generate robust cash flow amid sub-optimal utilization over the near term. We remain committed to returning essentially all free cash flow to shareholders and are pleased to announce a second $400 million share repurchase authorization.”

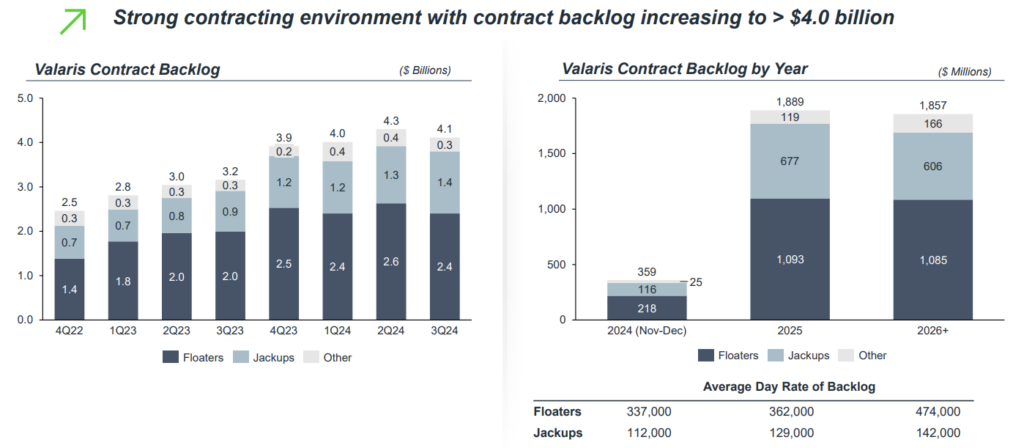

Valaris scores $4.1 billion in backlog

While Valaris has obtained a $4.1 billion backlog in Q3 2024, this is still lower than $4.3 billion at the end of July 2024, but 30% higher than $3.04 billion in Q3 2023. The firm’s 53-strong rig fleet, which consists of 18 high-specification floaters and 35 jack-ups, has seen over 96% revenue efficiency for each of the past three years.

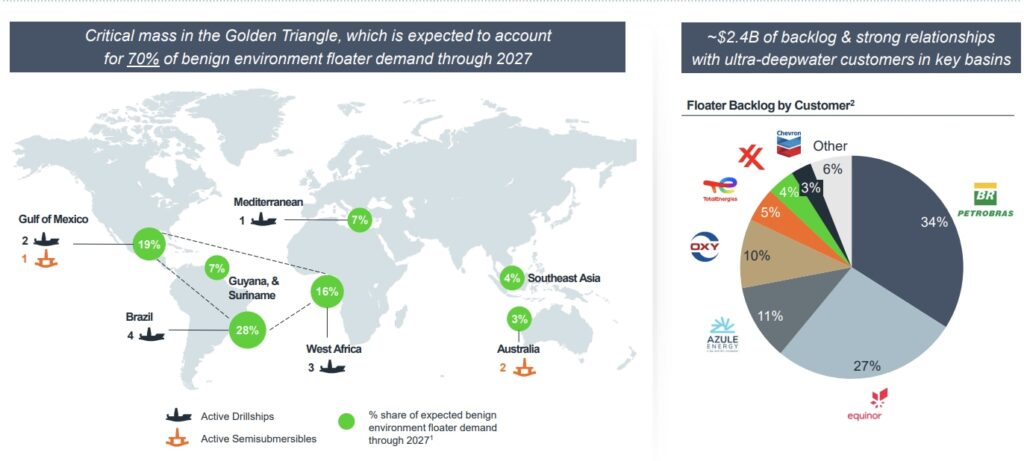

According to the rig owner, the benign environment floater demand is expected to increase at a compound annual growth rate of 6% through 2027 with the Golden Triangle, comprising South America, the Gulf of Mexico, and West Africa, expected to account for about 70% of demand through 2027. While exploration activity is anticipated to account for around 25% of demand through 2027, the previous exploration success in locations such as Namibia and Suriname is forecasted to drive significant growth in development activity in 2026 and beyond.

Valaris claims that drillship day rates are perceived to be well below the prior cycle peak while leading-edge day rates are greater than or equal to $500,000. The firm’s research shows approximately 30 long-term floater opportunities with expected start-up primarily in 2026. In contrast, prior cycle peak day rates were over $800,000. The firm claims that day rates would need to be at these levels or higher for an extended period to incentivize newbuild rig orders.

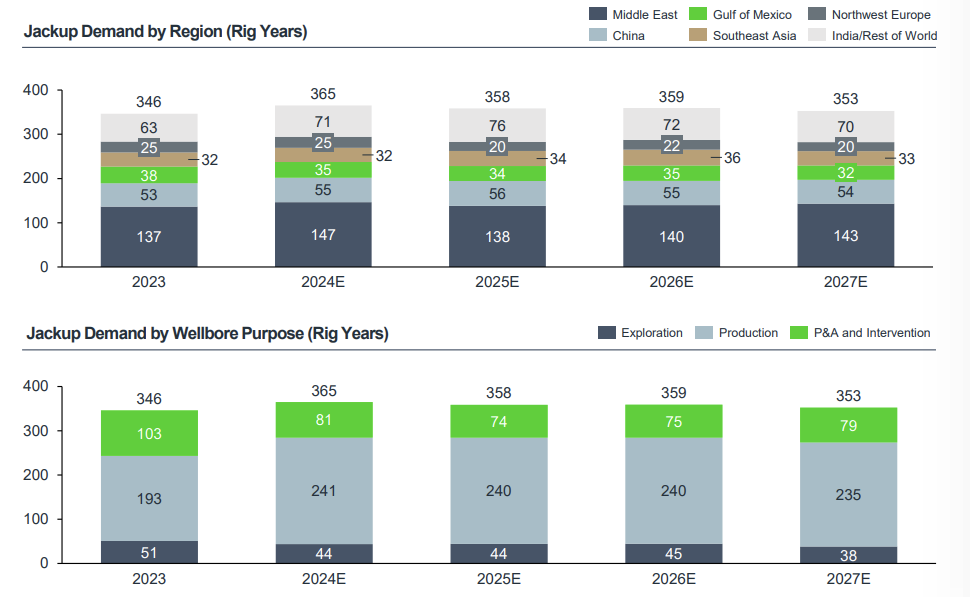

The jack-up demand is expected to remain stable over the next few years, however, the Middle East is predicted to account for approximately 40% of shallow water demand through 2027. While nearly two-thirds of all jack-up demand through 2027 is anticipated to be for production drilling, including around 35% for infill work on producing assets, the increasing number of longer-term new energy and plug and abandonment (P&A) projects in the North Sea could result in incremental demand.

While utilization and day rates for modern benign environment jack-ups are approaching the prior cycle peak, the North Sea jack-up market is at an earlier stage in its recovery. The firm underlines that the improved market backdrop and commercial execution have led to a backlog hike at higher day rates.

Valaris completed six drillship reactivations but three stacked seventh-generation drillships remain in its fleet. The company intends to pursue strategic growth opportunities if they are value-enhancing and accretive to its shareholders. The rig owner believes that the offshore drilling industry is in a structural upcycle, thus, it is convinced that it is well-positioned to benefit from the upcycle under a high-specification fleet and a strong operational and safety track record.

Furthermore, the firm sees a positive market backdrop for securing new contracts at higher day rates that support expected earnings and cash flow growth over the next few years, thus, it intends to return all future free cash flow to shareholders unless there is a better or more value accretive use for it.

Anton Dibowitz, Valaris’ President and Chief Executive Officer, noted: “We delivered strong operating performance and financial results in the third quarter, including solid free cash flow generation. Our fleetwide revenue efficiency of 98% included a full quarter of operations for Valaris DS-7 following its contract startup in the second quarter. Building on our track record of safe, reliable and efficient operations, we are proud to be recognized for the second consecutive year by the Center for Offshore Safety with its Safety Leadership Award for the development of our Restricted Zone Analysis tool.

“We maintain our conviction in the strength and duration of this upcycle and believe Valaris is well positioned to drive long-term value creation. While we have seen some customer demand deferred, the outlook for 2026 and beyond remains robust. We continue to focus on securing attractive, long-term work for our available rig fleet to support our earnings and cash flow growth.”

Related Article

Valaris’ net income decreased 58% to $63 million from $151 million in the second quarter of 2024. This net income included a tax expense of $24 million compared to a tax benefit of $30 million in the second quarter. The firm’s adjusted EBITDA increased 8% to $150 million from $139 million in the second quarter primarily due to a full quarter of operations for the Valaris DS-7 drillship following its contract startup and higher average daily revenue for the floater fleet, partially offset by lower utilization for the Valaris DPS-5 and DS-10 floaters as well as out of service time and repair costs for the Valaris 249 rig due to leg repairs.

The rig owner’s revenues increased 5% to $643 million from $610 million in the second quarter of 2024. Excluding reimbursable items, revenues increased to $598 million from $573 million in the second quarter primarily due to an increase in operating days and amortized mobilization revenue associated with the Valaris 247 rig, a full quarter of operations for the Valaris DS-7 drillship, and higher average daily revenue for the floater fleet, partially offset by lower utilization for the Valaris DPS-5 and DS-10 drillships as well as out of service time for the Valaris 249 MODU.

The firm’s contract drilling expense rose to $462 million from $439 million in the second quarter of 2024. Excluding reimbursable items, contract drilling expense jumped to $423 million from $407 million in the second quarter, primarily due to an increase in amortized mobilization expense associated with the Valaris 247 rig and higher costs associated with a full quarter of operations for the Valaris DS-7 drillship, partially offset by lower reactivation expense and lower personnel costs for the Valaris DS-17 floater associated with a change in operating location.

The floater revenues surged to $389 million from $384 million in the second quarter of 2024. Excluding reimbursable items, revenues increased to $373 million from $370 million in the second quarter. The increase was primarily due to more operating days for the Valaris DS-7 drillship, which began a contract in the second quarter, and higher average daily revenue for the floater fleet mostly due to the Valaris DS-16 rig, which started a new higher day rate contract late in the second quarter, partially offset by fewer operating days for the Valaris DPS-5 and DS-10 floaters, which completed their contracts in the third quarter.

The floater fleet’s contract drilling expense decreased to $248 million from $257 million in the second quarter of 2024, primarily due to lower reactivation expenses as the Valaris DS-7 rig returned to work in the second quarter and lower personnel expenses for the Valaris DS-17 floater associated with a change in operating location, partially offset by higher costs associated with a full quarter of operations for the Valaris DS-7 rig.

The offshore drilling player’s jack-up revenues climbed to $214 million from $186 million in the second quarter of 2024, primarily due to operating days and amortized mobilization revenue associated with the Valaris 247 rig, which started a contract offshore Australia in July, following its mobilization from the UK, which was partially offset by out of service time for leg repairs on the Valaris 249 rig.

The firm’s contract drilling expense increased to $157 million from $123 million in the second quarter of 2024, primarily due to a boost in amortized mobilization expense associated with the Valaris 247 jack-up and repair costs for the Valaris 249 rig.

ARO Drilling, a 50/50 joint venture between Valaris and Aramco, recorded a revenue decrease to $114 million from $124 million in the second quarter of 2024, primarily due to the contract termination for the Valaris 143 rig in the second quarter and contract suspensions, which later turned to terminations, for the Valaris 147 and 148 rigs during the third quarter.

Dibowitz concluded: “As expected, our free cash flow profile improved relative to the first half of the year, and we repurchased $100 million of shares during the third quarter. We remain committed to returning all future free cash flow to shareholders unless there is a better or more value accretive use for it.”

Borr Drilling cinches backlog of $1.62 billion

The company’s Q3 2024 backlog of $1.62 billion is lower than the $1.63 billion recorded in Q2 2024 and $1.86 billion in Q3 2023. Based on Borr Drilling’s data, energy commodity prices remained relatively stable during Q3 2024 compared to the second quarter of 2024, with Brent oil prices averaging approximately $80 per barrel compared to approximately $85 per barrel in the second quarter of 2024.

Despite the turbulent global macroeconomic environment, the firm underscores global demand for offshore drilling services, including jack-up rigs, remains strong, but uncertainty persists. As a result, oil benchmark prices are expected to remain volatile given the current global economic uncertainty and geopolitical events affecting supply and demand. Additionally, the geopolitical unrest and any expansion or increase of conflict in the Middle East may result in oil supply disruptions and cause further volatility in commodity prices.

With this in mind, the firm underlines that the demand for jack-up rigs may not remain at current levels, and may decline. Recently, the firm received the newbuild Vali rig and expects to take delivery of its remaining Var rig in mid-November 2024. This rig is yet to be contracted and has increased the size of the company’s fleet.

Related Article

-

Borr Drilling’s newbuild jack-up rig done with prep for its maiden assignment in Africa

Business Developments & Projects

The rig owner claims to have improved its liquidity and debt maturity profile through the issuance of senior secured notes due 2028 and 2030, and its private placement of shares in Norway equivalent to gross proceeds of $50 million, each in the fourth quarter of 2023 and issuance of $200 million, $150 million aggregate principal amount of additional senior secured notes due 2028 and $175 million aggregate principal amount of additional senior secured noted due 2030, in the first, third and fourth quarters of 2024, respectively.

Borr Drilling’s 23-rig fleet secured total operating revenues of $241.6 million, a decrease of $30.3 million or 11% compared to $271.9 million in the second quarter of 2024. The firm’s net income of $9.7 million experienced a decrease of $22.0 million or 69% compared to $31.7 million in the second quarter of 2024. The firm’s technical utilization was 98.7% but the economic one was 96.9%.

The rig owner’s adjusted EBITDA of $115.5 million saw a decrease of $20.9 million or 15% compared to $136.4 million in the second quarter of 2024. This year, the company obtained 17 new contract commitments, representing 4,129 days and $731 million of potential contract revenue. Total assets were worth $3.34 billion in Q3 2024, a 5% increase from nearly $3.2 billion last quarter.

Patrick Schorn, Borr Drilling’s CEO, said: “The operational performance in the third quarter was solid, with a technical utilization rate of 98.7% and an economic utilization rate of 96.9%. As expected, our third quarter financial results came in slightly below those of the second quarter. This difference was primarily due to one-off items in the second quarter related to the change in operating structure of our Mexico JV contracts and suspension of the ‘Arabia I,’ both of which had positively impacted prior quarter results.”

Related Article

While the offshore drilling player’s Mist rig secured an extension with Valeura Energy and is now firmly contracted until August 2026, the Prospector 1 jack-up had further options exercised and is now firmly occupied until July 2025, and the Hild rig secured an extension with Fieldwood Energy and is now firmly busy until Q1 2026.

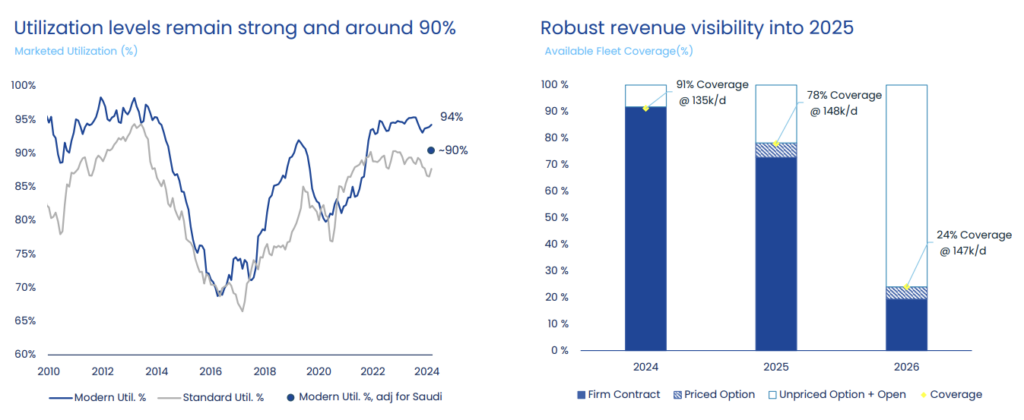

Schorn underscored: “Concerns about near-term oil supply exceeding demand have recently led customers to exercise greater caution in confirming rig contracts and options, and, in some cases, to delay the start of new projects. This, coupled with the lingering impact of rig suspensions in Saudi Arabia earlier this year and potential suspensions in Mexico, is creating uncertainties in the jack-up market in specific regions.

“Consequently, there is a risk of contract delays and potential gaps in activity in the coming quarters. Due to these developments in the market, we have updated our full-year 2024 adjusted EBITDA guidance of $500 to $550 million to be at or about the lower end of the range.”

The firm’s Gunnlod jack-up began its contract with ExxonMobil in November, Gerd is in transit to Congo and is expected to commence its contract this month, while Arabia 1 and Vali are undergoing contract preparations and are due to commence their respective contracts in Q1 2025.

The firm’s CEO added: “Borr is well-prepared for potential market volatility, with 78% of its rig fleet already contracted through 2025 at an average day rate of $148,000 per day, which is 10% higher than in 2024. The fundamentals of the global jack-up rig market remain robust and particularly favorable for Borr.

“The age profile of the global fleet, with 30% of rigs over 35 years old, is anticipated to drive additional retirements. Combined with the absence of new rig orders over the past decade, these conditions create a favorable environment for our company, which operates the youngest fleet of 24 premium rigs in the industry.”

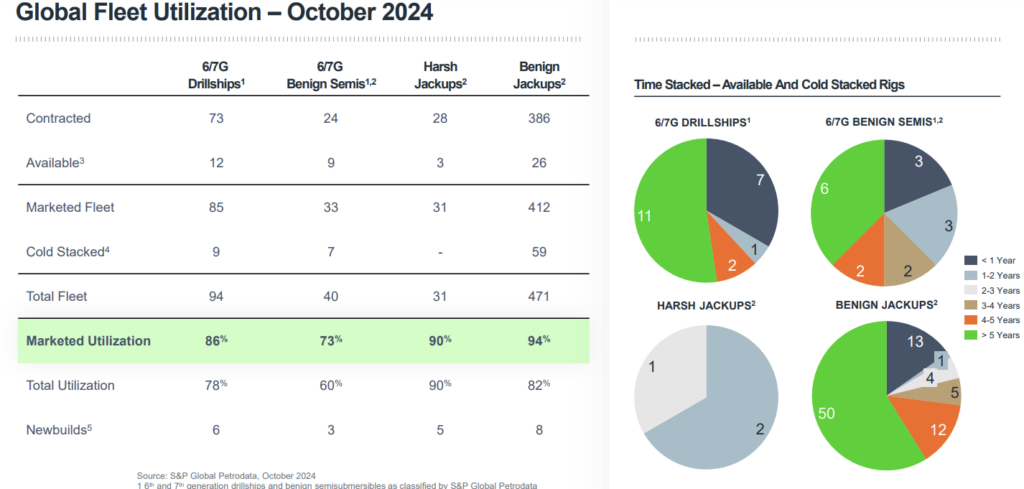

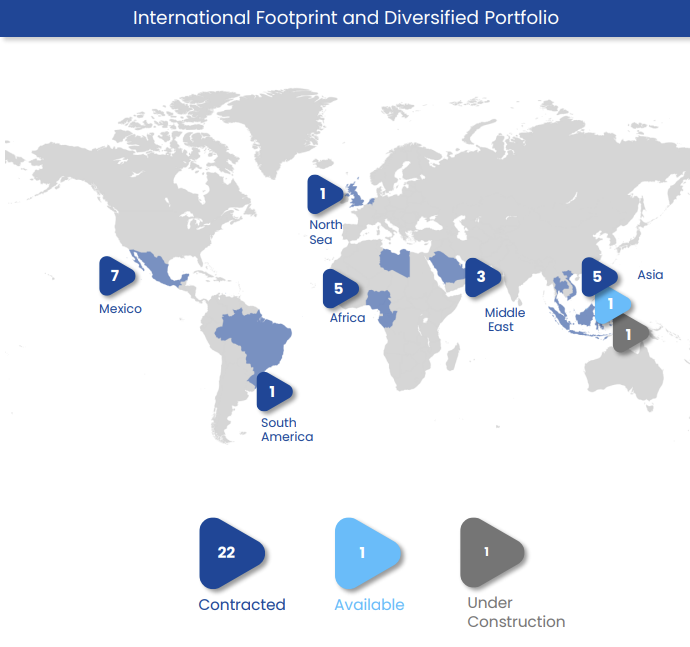

Based on the firm’s records, 22 of its 23 delivered rigs are contracted or committed: one in the North Sea, three in the Middle East, five in Africa, five in Southeast Asia, seven in Mexico, and one in South America. According to Petrodata by S&P Global, the marketed utilization for jack-up rigs globally stood at 93.2% in September 2024, unchanged from September 2023, while the marketed utilization for the modern jack-up fleet was 94.5% at the end of September 2024, and currently stands at 94.2%.

Currently, 312 modern jack-ups are contracted, representing an increase of approximately 75 units compared to the lows in late 2020 while 10 newbuild rigs remain under construction, including the Var rig scheduled to be delivered in mid-November 2024. These rigs under construction account for 2% of the globally marketed jack-up fleet. Given the ongoing supply chain challenges, Borr Drilling expects that a few of these rigs will join the marketed fleet shortly as many are in the early stages of construction.

Odfjell Drilling wins backlog of $2 billion

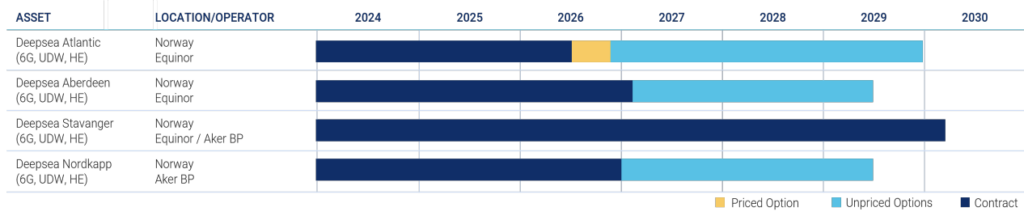

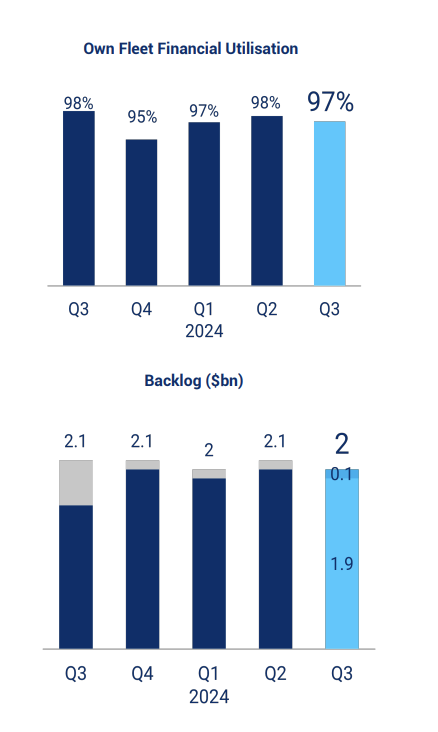

The rig owner’s $2 billion order backlog in Q3 2024 is slightly lower than the $2.1 billion secured in Q2 2024 and Q3 2023. The firm claims to have achieved strong results despite special period survey (SPS) downtime. The firm reported a Q3 2024 EBITDA of $83 million and a revenue of $186 million with a 97% financial utilization. The company has secured a backlog until mid-2026. Odfjell Drilling’s order backlog of $2 billion encompasses $1.9 billion from firm contracts and $0.1 billion from priced options.

Kjetil Gjersdal, Odfjell Drilling’s CEO, elaborated: “The third quarter of 2024 marked a significant milestone for Odfjell Drilling. Our team successfully completed the most challenging Special Periodic Survey (SPS) and upgrade project in the Company’s history on the Deepsea Atlantic, bringing the rig back into operation on time and within budget. With the Deepsea Atlantic now back in operations at a higher day rate, we expect this to positively impact our future results.

“Achieving a stable EBITDA of USD 83 million during a quarter that included a complex upgrade project demonstrates the strong performance across our fleet. This also points to the higher earnings we anticipate as additional rigs transition to higher day rates late 2024 and in 2025.”

Related Article

-

Appraisal activities with Odfjell Drilling’s rig shed more light on gas discovery

Exploration & Production

The firm’s own fleet remained active throughout the quarter on the Norwegian Continental Shelf (NCS) and achieved an average financial utilization of 97%, despite operational downtime. The Deepsea Atlantic and Deepsea Stavanger rigs worked for Equinor during the period, with the second MODU working on various exploration projects.

The first rig completed its work on the Johan Sverdrup Phase II project in early Q3 2024 before it went to the yard for its SPS classification and also to receive multiple material upgrades, such as a new blow-out preventer (BOP) as well as work to increase the variable deck load capacity of the unit.

Having completed its SPS period in 19 days of net downtime, the unit returned to its assignment with Equinor at significantly higher day rates and achieved financial utilization of 98.2% for the remainder of the period. The Deepsea Stavanger rig achieved a financial utilization of 98.8%. The Deepsea Aberdeen semi-submersible was also on contract with Equinor on the NCS during Q3 and was working on the Breidablikk field. The unit achieved a financial utilization of 98.3% during the quarter.

Moreover, the Deepsea Nordkapp rig was working for Aker BP on various exploration projects and achieved a financial utilization of 94.5% but it also experienced some downtime in the final days of the period as it returned to shore to complete some minor repairs, returning to work in early October. The firm’s external fleet was active in Q3 2024 with three of four units operational throughout the entire period whilst the Deepsea Bollsta rig remained at a yard in Walvis Bay to complete its SPS.

The Deepsea Mira rig worked with TotalEnergies in Congo before mobilizing to Namibia, while the Deepsea Yantai semi-sub was working with Shell on the NCS. The Hercules rig began work in Canada and has since been demobilized.

Related Article

-

TotalEnergies embarks on high-impact exploration drilling ops offshore Namibia

Exploration & Production

“With firm contracts in place for our owned rigs through at least mid-2026, we are well positioned to continue delivering robust returns to our stakeholders. Supported by our solid contract backlog and reliable operations, we remain confident in the long-term prospects of our business. Reflecting this optimism, we have declared a dividend for the third quarter and have the intention to increase the quarterly dividend in connection with the Q4 2024 results,” highlighted Gjersdal.

The operating revenue for the firm’s own fleet segment in Q3 2024 was $144 million driven by lower revenue for the Deepsea Atlantic rig due to the SPS yard stay in 2024 and lower revenue for the Deepsea Stavanger semi-sub due to a lower bonus, offset by higher revenue for the Deepsea Nordkapp rig due to increased day rate. The operating revenue for the external fleet was $42 million. Thanks to this, the total operating revenue for Q3 2024 was $186 million and EBITDA was $83 million, a decrease of $4 million mainly due to reduced EBITDA in the company’s own fleet.

With its own fleet booked until at least mid-2026, Odfjell Drilling remains confident about the ability of its units to continue to attract higher day rates at renewal, anticipating demand for tier 1 harsh environment semi-submersibles to increase and supply to marginally reduce.

Regarding future work in 2024 and 2025, the firm claims that demand remains consistent in its core market of Norway, where it sees requirements for harsh environment drilling rigs with operators such as Vår Energi, OKEA, and Harbour Energy.

Aside from traditional drilling campaigns, the firm will be drilling three carbon capture and storage (CCS) wells for clients in the coming months and expects incremental demand for drilling CCS wells in the future.

Internationally, the demand in West Africa remains high, with operators seeking rigs to complete smaller campaigns as confirmed by the Deepsea Bollsta rig’s assignment with Springfield Energy.

Odfjell Drilling anticipates demand to increase in the long term, as areas such as the Orange Basin of Namibia and potentially South Africa, continue to mature. The firm believes demand in areas such as Suriname and the Falkland Islands will continue to be considered, which will also add to demand in 2025 and onwards. With no newbuilds likely to enter the market soon, the rig owner remains optimistic that the market will remain well balanced; facilitating strong, increasing day rates for its rigs.

Meanwhile, Odfjell Drilling continues to work closely with partners, clients, and the government to reduce emissions from its operations and achieve its targets for net zero by 2050. The firm has achieved a 30% cut in absolute emissions per well for its rig fleet compared to the reference year 2019 as a result of its own fleet experiencing a significant decrease in CO2 emissions due to more efficient drilling, a new anchoring philosophy, and other modifications.

Related Article

-

One Odfjell Drilling-managed rig taking care of SPS in Norway as another kicks off work offshore Ghana

Business Developments & Projects

Odfjell Drilling underscores that rig modifications, including a hybridized power system, have resulted in fewer generators and a significant reduction in power consumption related to cooling. Scope 1 CO2e emissions in Q3 2024 were 995 t CO2e mainly due to the special periodic survey conducted for the Deepsea Atlantic rig.