T&E: Two-thirds of European green shipping fuel projects may never come online as supplies fear lack of demand

Nearly 4% of European shipping could run on green e-fuels by 2030 but just a third of these projects are guaranteed, putting Europe’s climate ambitions at risk, Transport and Environment (T&E) warns in a new study.

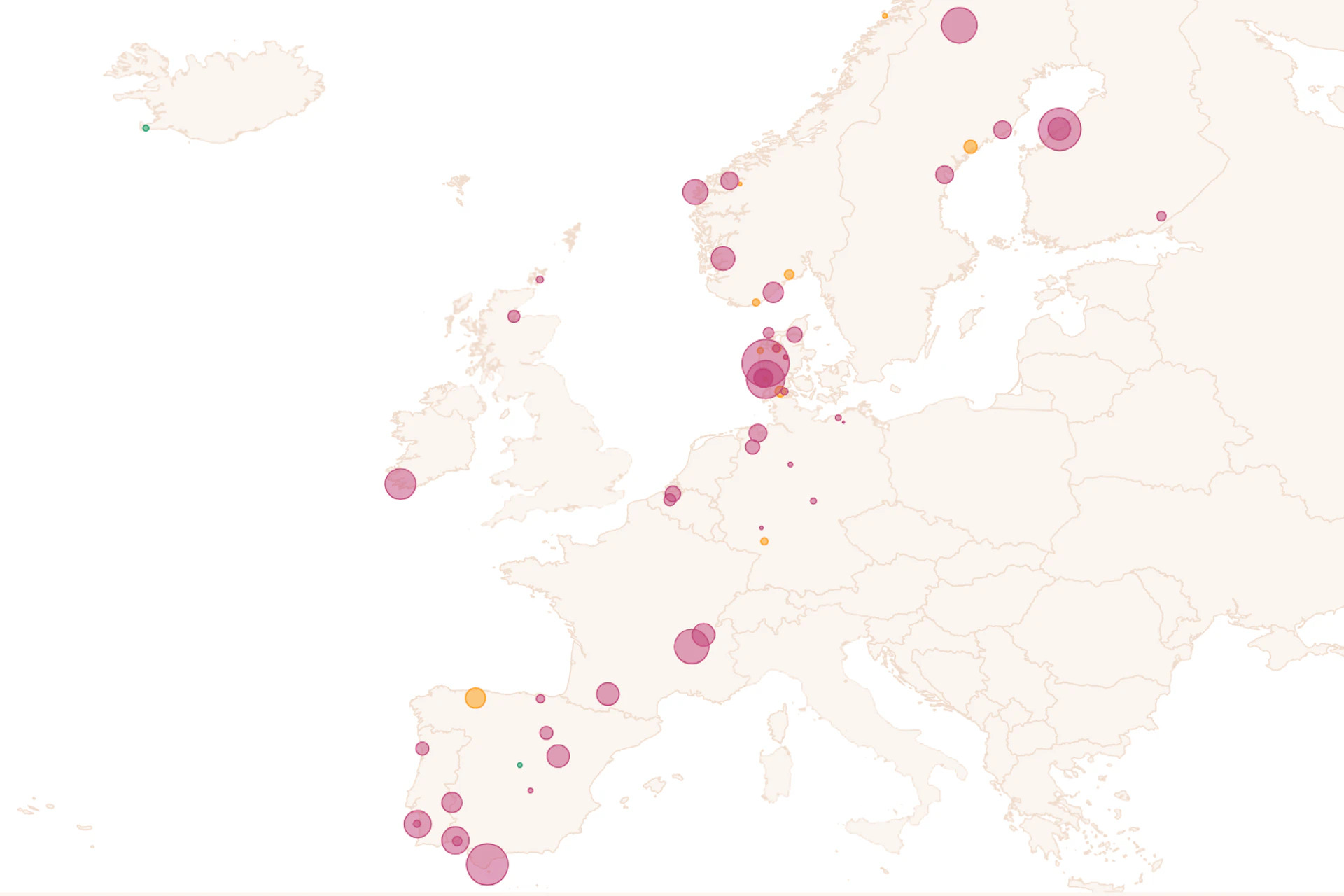

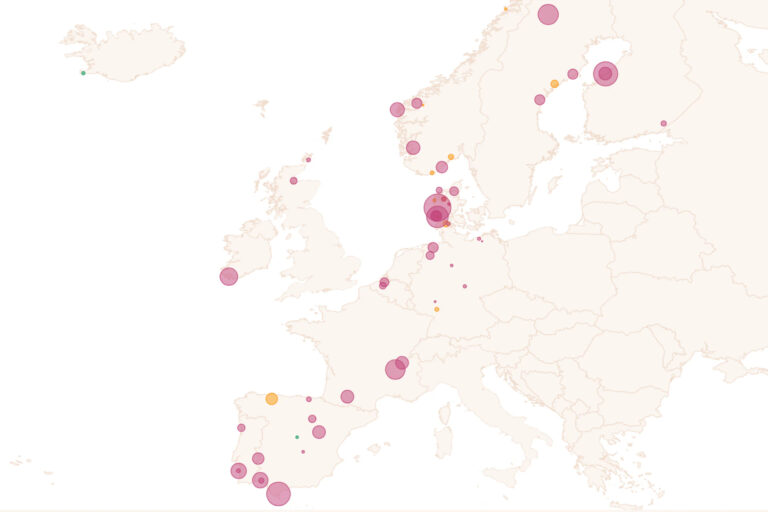

T&E’s mapping of green hydrogen projects across Europe shows that around 4% of European shipping could run on green e-fuels by 2030. However, the new analysis found that two-thirds of these projects are at risk as fuel supplies fear a lack of demand.

This means that just a third of European green shipping fuel projects are guaranteed, T&E warns.

According to T&E’s study, fuel supplies appear to be reluctant to commit financially to projects without more guarantees that there will be demand for these fuels in the near future. This leaves the vast majority of projects at risk of never coming online in this decade, jeopardizing Europe’s climate ambitions and thousands of jobs.

Globally, it is estimated that green shipping could create 4 million new jobs by 2050.

Inesa Ulichina, Shipping Officer at T&E, said: “Hydrogen projects are popping up across Europe. They have the potential to power hard-to-decarbonise sectors like shipping and provide thousands of good jobs. But at the moment there just isn’t enough certainty and we risk missing this golden opportunity.”

Mapping done by T&E shows there are at least 17 projects across Europe, set up to provide hydrogen-based e-fuels for ships, which could meet 4% of European shipping’s total energy demand by 2030 if all of them become operational.

Additionally, T&E found 44 other hydrogen projects in Europe that could also provide green fuels for ships, but project developers eye other hydrogen-hungry industries, too.

T&E explained that the mapped projects would easily meet the European Union’s target of 2% green e-fuels in 2034, however, most projects are yet to receive funding and not a single shipping-dedicated project is operational.

Denmark alone accounts for more than half of all the planned hydrogen volumes across the 61 projects mapped by T&E. But in terms of fuels earmarked for shipping, Spain leads the way and is home to a third of the potential fuel supplies. The UK has very few projects while T&E found none in Italy and Greece.

T&E’s analysis indicates that, in the long run, e-ammonia appears to be the more popular option, making up 77% of potential volumes. To date, however, none of these projects has received a final investment decision.

T&E recommended that member states mandate at least 1.2% of shipping fuels to be e-fuels by 2030, as recommended by the EU’s green fuels law (RED III) as this would secure all the current projects that have already received funding and allow more projects to reach a final investment decision.

Revenues from the EU’s carbon market for shipping (ETS) should also be used to help nascent projects, said T&E.

“Shipping has a chicken and egg problem. E-fuels producers are waiting for clearer demand signals from ship operators before making large investments. Shipping operators, on the other hand, are waiting for these fuels to scale up and become cheaper before signing off-take agreements. The EU should ensure more supply and demand of e-fuels through regulation, which will provide fuel producers and shipping companies with investment certainty,” Ulichina concluded.