Melbana gets OK to simplify future work on Beehive

Melbana Energy’s application for a WA-488-P block work program credit has been approved by the National Offshore Petroleum Titles Administrator

(NOPTA).

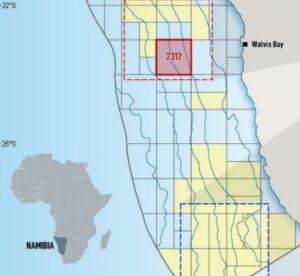

The offshore WA-448-P block contains the Beehive prospect, described as “potentially the largest undrilled hydrocarbon prospect in Australia.”

At the moment, a 3D seismic survey is being conducted at the block, and the work program credit approval means the regulator has given approval for Beehive 3D Seismic Survey currently underway in Permit Year 2 to be completed earlier than originally planned.

The Beehive 3D seismic survey is being carried out to further de-risk the prospect and help with defining of a preferred location for the Beehive-1 exploration well.

The company’s CEO, Robert Zammit, said: “The crediting of the Beehive 3D seismic survey being acquired in Year 2 against the Year 4 work commitment will streamline and simplify the future work program for the WA-488-P permit.”

The Beehive 3D seismic survey is currently being acquired by Polarcus using the Polarcus Naila vessel and will consist of the acquisition of approximately 600 square kilometers of seismic data over the prospect located in the Melbana-operated WA-488-P permit in the Joseph Bonaparte Gulf some 225 kilometers southwest of Darwin.

The survey is being operated by Australian energy company Santos under an operations services agreement and is fully funded by Santos and French oil major Total.

Melbana to pay if commercial discovery made

The companies funding the survey, Total and Santos, have an option (exercisable together or individually) to acquire a direct 80 percent participating interest in the permit in return for fully funding the costs of all activities until completion of the first well in the WA-488-P permit. If that happens, Melbana retains 20 percent and will be fully carried for the first exploration well.

Beehive is located close to several existing facilities including Ichthys project and Blacktip field and pipeline offering several options for future gas monetization. In the event of a commercial discovery, Melbana will repay carried funding from its share of cash flow from the Beehive field.

Melbana will have no re-payment obligations for such carried funding in the event there is no commercial discovery and development in WA488-P.

388 million barrels of oil equivalent

According to Melbana, the Beehive prospect is potentially the largest undrilled hydrocarbon prospect in Australia. It is a Carboniferous age 180 square-kilometer isolated carbonate build up with 400 meters of mapped vertical relief, analogous to the giant Tengiz field in the Caspian Basin.

It is located in 40m water depth suitable for a jack-up rig, within 75 kilometers offshore and developable by either FPSO or pipeline to existing infrastructure. This play type is new and undrilled in the Bonaparte Basin with no wells having been drilled to this depth in the basin.

The carbonate reservoir is also interpreted to be the same age as the 2011 Ungani-1 oil discovery in the Canning Basin, which tested at 1,600 bopd demonstrating a high quality reservoir. The company said that Beehive was a much larger buildup than Ungani and had excellent access to the Lower Carboniferous source rock in adjacent depocentres.

Independent Expert McDaniel & Associates (Canada) assessed Beehive Prospective Resource as 388 million barrels of oil equivalent in best case scenario. McDaniel & Associates Report estimates Prospective Resources to range from 91 (low) to 1.6 billion (high) barrels of oil equivalent with 25% improvement in Chance of Success.

Offshore Energy Today Staff