JERA invests in CO2 emissions visualization cloud service provider

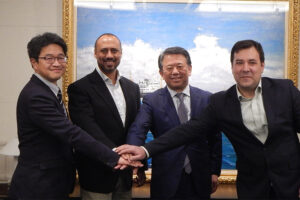

Japan’s major JERA, through JERA Ventures, has invested in Asuene, a compatriot company that provides cloud service for visualizing, reducing and reporting CO2 emissions.

According to JERA, as societal demand for companies to reduce CO2 emissions throughout their entire supply chains grows, there is a need for a solution that calculates and visualizes CO2 emissions, leading to CO2 emission reductions. Asuene provides this service to customers both in Japan and overseas.

In order to realize a decarbonized society, JERA noted that the group provides support through JERA Cross, from designing future visions and formulating strategies for customers’ GX to developing and supplying renewable energy necessary for decarbonizing electricity, while also working to resolve customers’ issues, transform their businesses and reduce CO2 emissions, such as by providing a stable supply of carbon-free electricity 24/7.

“Through this collaboration through investment in Asuene, we aim to further improve the transparency of 24/7 carbon-free electricity supply by utilizing the ‘CO2 visualization service’ provided by Asuene. We believe that this will increase the transparency of customers’ efforts toward decarbonization and contribute to the promotion of GX for companies,” JERA stated.

To remind, JERA Cross was established in May 2024 with the intention to combine JERA’s energy, digital and business transformation capabilities to accelerate corporate “green transformation.”

At the time, JERA said that the new business would apply renewable energy supply-and-demand management and sales functions that leverage JERA’s expertise and digital technology in the energy domain to provide end-to-end decarbonization solutions spanning from management to execution.

Related Article

-

JERA launches new company to spur corporate ‘green transformation’

Business Developments & Projects

In the same month, JERA unveiled a new growth strategy that integrates three key business pillars – LNG, renewables, and hydrogen and ammonia – along with an investment of 1-2 trillion yen (around $6-$12.9 billion) for each business pillar, and organizational edge, marking a pathway towards 2035, and ultimately its 2050 zero-emission goals.

In addition, the company announced its financial strategy and key financial targets, aiming to reach a consolidated net profit of 350 billion yen (around $2 billion) and an EBITDA of 700 billion yen (around $4.5 billion).

Related Article

-

JERA to invest $32 billion in LNG, renewables, hydrogen and ammonia by 2035

Business & Finance