Farm-out process offshore Uruguay and decision on assets in Trinidad & Bahamas coming in mid-2025

Isle of Man-headquartered oil and gas company Challenger Energy Group (CEG) is making progress in setting the stage to embark on a formal farm-out process later this year for a shallow water exploration block off the coast of Uruguay. As the firm is also expected to make up its mind about assets in Trinidad and the Bahamas around that time, the first half of 2025 promises to be a busy time for the company.

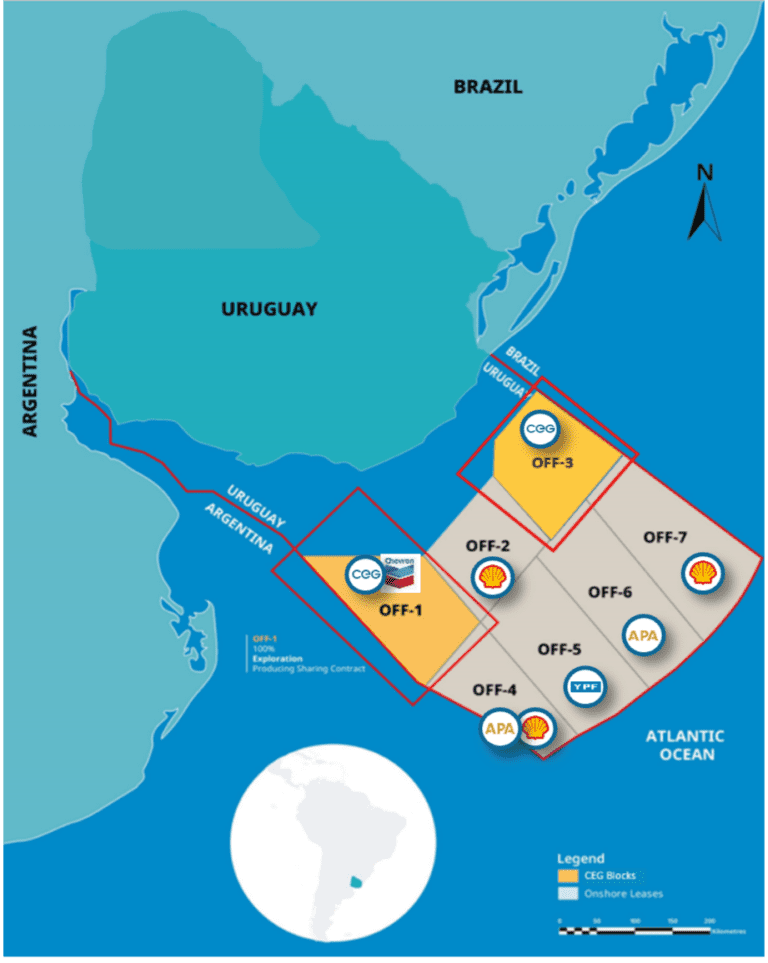

After Challenger Energy submitted a bid for the AREA OFF-3 block offshore Uruguay as part of the Open Uruguay Round, the first instance of 2023, the Administración Nacional de Combustibles Alcohol y Pórtland (ANCAP), the Uruguayan national regulatory agency, awarded the license for the block to the company in July 2023.

Thanks to this, the firm expanded its footprint in Uruguay to two blocks in the offshore Punta del Este and Pelotas sedimentary basins: AREA OFF-1 and AREA OFF-3. The formal signing of the AREA OFF-3 license occurred in March 2024. The first exploration period started on June 7, 2024, and will run for four years, until June 6, 2028.

No prior wells were drilled on the AREA OFF-3 block. However, considerable seismic activity did get collected, comprising approximately 4,000 km of legacy 2D and around 7,000 km of 3D, as part of the 2012 proprietary acquisition carried out by BP and PGS.

Two material-sized prospects, Amalia and Morpheus, which were identified and mapped on the block, currently have an estimated gross resource potential of up to 2 billion barrels of oil and around 9 trillion cubic feet of gas.

Related Article

Eytan Uliel, Chief Executive Officer of Challenger Energy, commented: “This highly prospective 13,252 km2 area, located in relatively shallow waters about 100 kilometers off the Uruguayan coast, benefits from extensive 2D and 3D seismic coverage and, like AREA OFF-1, has multi-billion-barrel resource potential from multiple play types. We have since commenced our technical work program for AREA OFF-3, which centers around reprocessing 3D seismic data.

“This critical activity, set to conclude in the first half of 2025, will refine the prospect inventory, identify potential drill locations, and support a formal farmout process targeted to commence in mid-2025. The anticipated costs of our work program, projected at $1-1.5 million, reflect our commitment to a disciplined and value-driven approach to early-stage exploration.”

This block and the broader offshore Uruguay play system are analogous to offshore Namibia, where recent prolific, conjugate margin discoveries came to light, including TotalEnergies’ Venus-1 oil discovery and Shell’s Graff-1 oil discovery. Challenger intends to follow a similar strategy to the one adopted for the AREA OFF-1 license, which included the farm-out to Chevron.

Related Article

While the firm’s primary focus is on its high-impact Uruguay exploration acreage, it also has three onshore production assets in Trinidad, encompassing the Goudron, Innis-Trinity, Icacos fields, and four offshore exploration licenses in the Bahamas, where a number of structures and drill targets remain prospective across the license areas, with a renewal pending for a third three-year exploration period.

Currently, the company is reviewing these assets in Trinidad and the Bahamas, aiming to decide on their future in the first half of 2025. The funds received on completion of the Chevron farm-out make the company fully funded for the foreseeable future.

“I believe our company is in the best financial position it has been in for many years. 2024 underscores Challenger Energy’s ability to navigate complex projects, partner with leading industry players, and leverage our assets to create value for shareholders,” concluded Uliel.

“As we look ahead to 2025, our focus remains steadfast: advancing exploration activities in Uruguay, optimizing our portfolio, and continuing to execute on our business strategy.”